Aubrey Roga

Chief Executive Officer, Ascalon Capital

As Ascalon’s Chief Executive Officer, Aubrey brings over two decades of experience leading financial services businesses through growth, transformation, and strategic repositioning. Prior to Ascalon, he spent a decade as Managing Partner and CEO of SCM Financial Group, where he guided the firm’s evolution from boutique advice practice to a nationally respected player.

Throughout his career, Aubrey has remained focused on a single mission: making high-quality financial advice more accessible, scalable, and impactful. With experience spanning advice delivery, wealth strategy, and executive leadership, he understands how to balance client outcomes with commercial success.

At Ascalon, Aubrey leads with clarity and purpose — shaping the firm’s vision, driving performance, and championing a new standard of strategic advice across the industry.

Shane Hawke

Partner, Head of Implemented Consulting and Investment Research

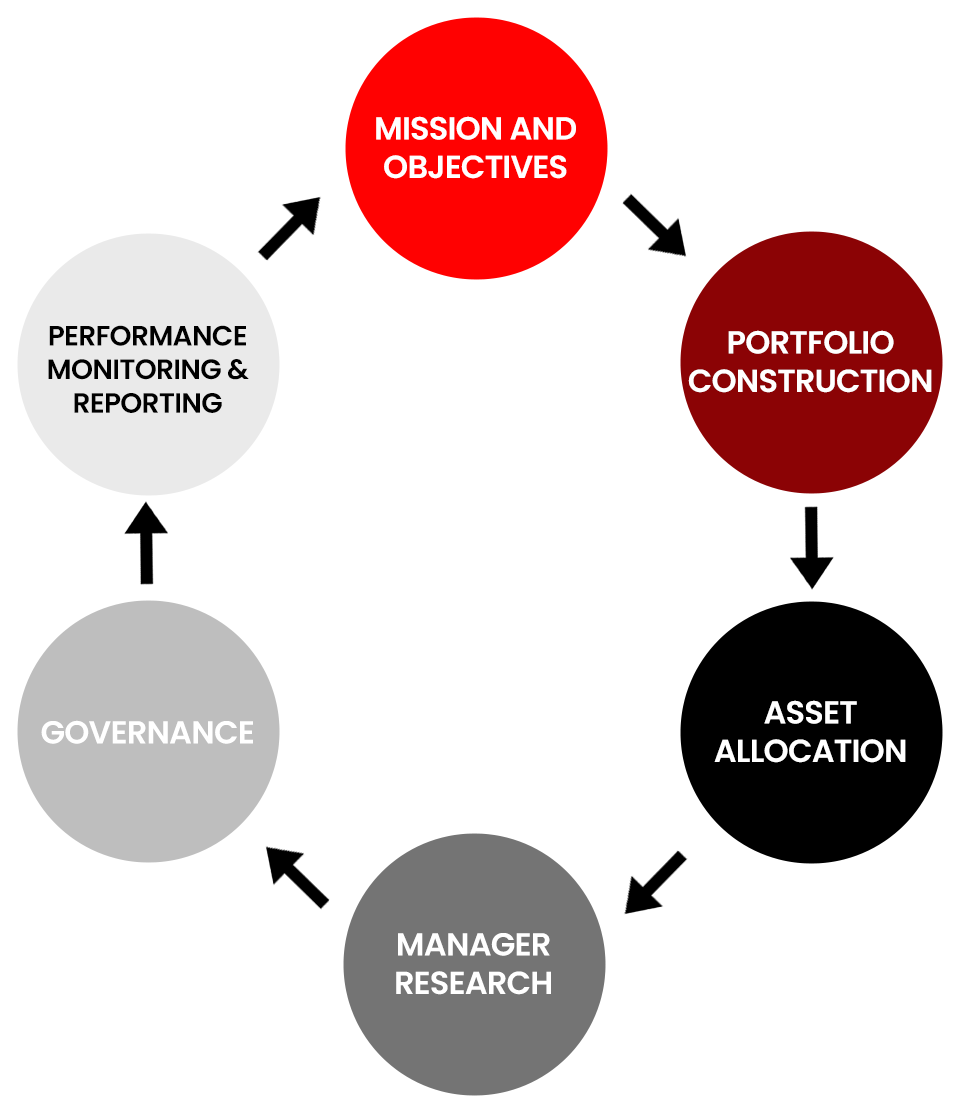

Shane has over 31 years in Financial Services with 25 years' experience in investment management roles covering a range of functions including investment research, portfolio construction, governance, asset allocation, risk management and communications. He has also spent over 5 years in financial planning roles.

Prior to his current role as Head of Implemented Consulting and Investment Research, Shane was the Managing Director / Head of Investments of Ascalon Capital for 2 years where he rebranded and launched Ascalon Capital. Other prior roles include as Head of Research and Advisory for Oreana Portfolio Advisory, and Manager - Research for NAB Wealth's research team (ThreeSixty Research), where he managed the investment research and portfolio construction of NAB Wealth Licensee's Approved Products Lists, Model portfolios and both the RE and Trustee Investment menus.

Dr Isaac Poole CIMA®

Executive Director, Chief Investment Officer

Isaac is one of the leading voices on global capital market and investing strategy in Australia and Asia. Isaac regularly appears on international news platforms including Bloomberg, CNBC, BBC World News, Ausbiz TV and Asia Times Financial.

Prior to joining Ascalon Isaac was Global CIO for Oreana Portfolio Advisory. Isaac also worked at Willis Towers Watson as the Head of Capital Markets Research in the Asia-Pacific. Isaac's focus in this role was delivering asset allocation solutions to improve portfolio outcomes and returns.

Other prior roles include Chief Economist at NSW Treasury Corporation, and Manager of Economic Risk at Lloyds Banking Group.

Isaac's impressive track record is underpinned by a PhD in Economics from the University of Sydney and he is a Certified Investment Management Analyst.

Dr Evelyn Looi

Investment Consultant

Evelyn is a dynamic professional with a passion for investment and research. With over 15 years of research experience and nearly eight years in investment management, her expertise lies in macroeconomic monitoring, investment manager research, portfolio construction and management, marketing, and communications. Her diverse career includes significant roles in investment management, academia, and consultancy.

Prior to joining Ascalon Capital, Evelyn was a Deputy Portfolio Manager at Activam Group and formerly Activus Investment Advisers. She also worked as a Research Analyst at Activus Research, where she conducted research and due diligence on investment managers, analysed data, and authored ratings reports. Further, she developed an app for financial planners in Malaysia for her Honours project in 2005.

Evelyn holds a PhD in Management from the University of Otago, an MSc in Management Research from the University of Glasgow, and a First-Class Honours degree in Business Information Technology from Coventry University. Additionally, she has earned the Financial Planning & Wealth Management Certification from the Corporate Finance Institute and is currently pursuing CFA Level 1.

Louise Liu CFA

Investment Analyst

Louise joined the team in July 2019 as an Investment Analyst. She has responsibilities across the entire portfolio management process and economic and market research.

Louise's previous roles have enabled her to gain experience in finance, compliance, and consulting industries as an intern.

Louise holds a Bachelor of Science in Economics and Finance from the Hong Kong University of Science and Technology, with experience in computer programming. Louise has completed CFA Level 2.

Florence Savage

Investment Analyst

Florence joined the team in July 2020 as an Investment Analyst. She has responsibilities across the entire portfolio management process as well as supporting the economic and market research capability.

Florence's previous roles have enabled her to gain experience as a macroeconomic analyst focusing on Asian economies.

Florence holds a degree in Economics from the University of London and a Masters from City University of Hong Kong.